It’s easy to go overboard for Christmas. Giving extravagant gifts to your family members seems like a great idea … until you’re facing a huge credit card bill.

It’s easy to go overboard for Christmas. Giving extravagant gifts to your family members seems like a great idea … until you’re facing a huge credit card bill.

However it happened, approach this problem rationally. Blaming yourself is pointless; the important thing now is to right yourself financially.

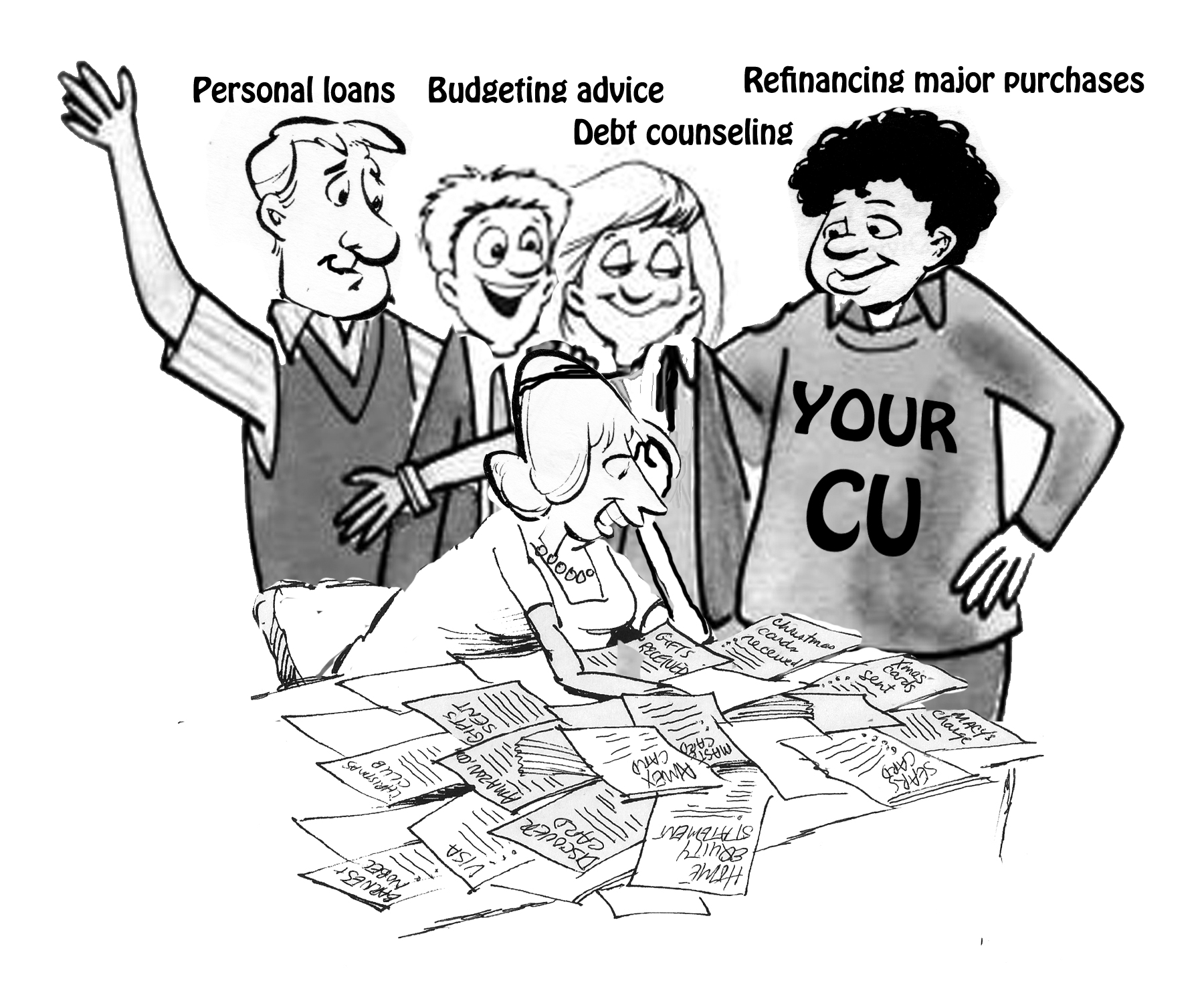

Fortunately, you’re not facing this alone. GreenState Credit Union is here to help. Check out these four ways you can patch up your finances and have things right before summer.

1. Budgeting advice

It’s very tempting to make only the minimum payments on the credit card you used to buy Christmas. Unfortunately, it’s also the best way to ensure you’re in debt for every Christmas to come.

Making minimum payments on credit cards prolongs the length of time you’re in debt and spikes the total amount you pay, adding an extra $175 to a $10,000 balance at 21% APR.

What you need is an aggressive debt repayment plan. Instead of looking to pay the smallest amount possible, identify the most you can afford to pay. GreenState Credit Union can help with informative guides and worksheets on household budgeting.

Commit to an extreme budget until you make headway on the debt. Coming up with an extra $35 or $50 a month is tough, but it’s the easiest way to get things moving.

2. Refinancing major purchases

If you splurged on one or two major purchases, it may not be credit card debt you’re facing. Some car dealers offer crazy-sounding incentives to entice people to give cars for Christmas. Unfortunately, when you realize you’re in over your head with a car payment, there’s no undoing the deal.

GreenState Credit Union can help. Our auto and other major purchase loans often feature rates that are better than those of dealerships. You may need to finance the purchase over a longer term, or you may need to restructure the loan to pay less now.

3. Debt counseling

Does reading those credit card statements fill you with despair? GreenState Credit Union can help you make sense of them.

Make an appointment to speak with a debt counselor through GreenState Credit Union. You’ll learn about your rights and responsibilities and create a realistic plan to pay off your debt and avoid falling into the same trap next year.

4. Personal loans

Instead of making dozens of minimum payments, focus your debt into one manageable plan through a debt consolidation. Amazingly, taking this step can save you money in the long run by lowering your interest rate and monthly payment commitment.

Collateral isn’t necessary. All you need is some basic personal information and a willing partner, like GreenState Credit Union. Our loan specialists can help you organize and simplify your payments, working toward a debt-free life.